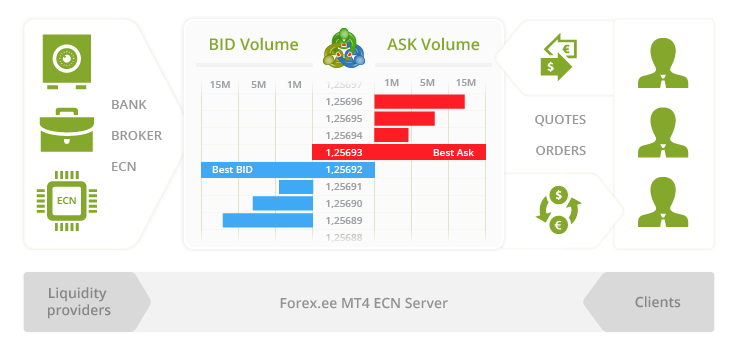

ECN (Electronic Communications Network) is an order processing system that excludes conflicts of interest between a broker and clients. Due to Forex market being largely unregulated with no Central Exchange, trading is performed in an OTC (Over the Counter) market. ECN technology provides direct access to the Forex Interbank market, where orders of traders can be offset one against another, making it possible to trade directly with other retail market participants. In order to provide execution at the best price, the system automatically allocates all buy/sell orders to the counterpart orders with matching parameters. Thus, trading with use of ECN technology is performed in such a way that all orders are placed in the common liquidity pool, which allows selecting orders of the matching instrument, price and volume for automatic ultra-fast execution.

Open an ECN account with Forexee:

- No requotes and ultra-fast order execution

- Tightest spreads

- No trading restrictions (including scalping, hedging, EAs and HFT)

- Transparency of Market Depth Data, i.e. everyone can see all orders placed for a chosen financial instrument

- Direct processing of orders to the liquidity providers

- Execution at the best price